The ad is a sign of the times for Nepal where owning a mobile phone has become common throughout the country, even on the slopes of Mt. Everest. The Nepal Telecommunications Authority reports that in August 2013 mobile phone penetration reached 72% of the population. Mobile “smart phones” have also contributed to the rapid increase in Internet penetration in Nepal, growing from 19% in 2012 to almost 27% in August of 2013.

Newspaper publishers in Nepal have begun to experience the early stages of their audience’s shifting media habits. Consequently, Nepal’s Centre for Investigative Journalism hosted “Doing Digital” a seminar for publishing executives trying to understand the challenges and opportunities presented by the digital transition. MDIF presented “Journalism in the Digital World” a summary of the opportunities and the challenges presented by readers, listeners and viewers all merging to become the digital audience. The digital transition is clearly a tale of the best of days and the worst of days, the good and the bad.

For publishers, the best of days is epitomized by the wealth of new tools and techniques. Digital has made online story-telling a new narrative form combining the use of text narrative, audio, video, data and infographics. Examples discussed included the New York Times’ Pulitzer Prize winning “Snowfall” as well as other examples from around the region. The discussion highlighted two key points. First, for these multimedia stories to be successful, journalism has to be combined with technology. Second, the recognition that most publishers do not have the resources of the New York Times and that there are free or low cost tools like Timeline.js to help publishers tell multimedia stories.

Digital technology has also made data journalism a new opportunity for journalists and their audiences to find patterns and stories in the data. Data journalism like Veja’s Rede de Escandalos provided tangible example of data journalism’s reporting power. One of Brazil’s oldest news magazines, Veja used its own past reporting on scandals in Brazil to create a unique database of scandals, actors, government bodies involved in each scandal.

Finally, digital technology revolutionizes the way publishers, editors and reporters communicate with their audience. Digital in many cases has turned audience communication into stories. India’s website “I Paid A Bribe” website demonstrated how audience engagement and communication can create ongoing coverage of key themes, like corruption.

But publishers attending the seminar also focused on the business models needed to survive the transition. Unfortunately, the discussion of business models presented the challenge facing all digital publishers, where will online revenue come from. The challenge is acute in countries like Nepal, where audience adoption of online has grown much faster than local advertisers’ transition to online.

During the seminar, MDIF discussed several examples of revenue streams that publishers should evaluate as they begin to actively publish online. Since online advertising remains a very small revenue opportunity in Nepal, the discussion focused on enterprise and project social funding services, often called crowdfunding. Crowdfunding services have expanded greatly with regional specialists, like Africa’s mobile fundraising platform M-changa or industry specialists like IndieVoices, which focuses on independent media and journalism projects. In addition to crowdfunding, syndication and content expense sharing partnerships were also discussed where two organizations partner to share the cost and potentially the revenue of a digital reporting project. Finally, different subscription and paid content models were presented. Though many of the Nepali publishers believed that the technology to easily collect revenue from their online audience was not yet available in Nepal.

Nepali media and media in any region undergoing a rapid digital transition face both opportunities and challenges. Digital reporting and story telling tools have created a whole ways of communicating a story. But, these new tools require training, technology and infrastructure support. None of these are free. Revenues from advertisers typically lag the audience’s move to digital platforms, creating a gap in digital’s ability to generate revenue. This leaves publishers who move online with the challenge of how to generate some new revenue to support these new requirements. CIJ Nepal’s seminar for regional publishers created a foundation for an active discussion and experimentation with both the opportunities and challenges facing Nepal’s traditional print media.

]]>Both on the speaker’s dais and among participants, there were several clear themes for news media publishers – “big data”, paid content, branding for news media, content packaging for targeted audiences, as well as clever approaches to creating new revenue from print. All of these themes support the view presented by Earl Wilkinson, INMA global CEO during his closing presentation. Wilkinson underscored that digital is here to stay. The presentation, distribution and management techniques characterized by successful digital media companies will progressively dominate in the media management world. Wilkinson emphasized that the adoption and evolution of these techniques are at different stages of development around the world. But in every case, digital content creation and distribution and the supporting tools will be the key to future success in digital as well as print.

First among the digital themes has to be “big data” and its role in developing advertising and audience. Frode Eilersten, Schibsted’s newly appointed Executive Vice President for Strategy and Digital Transformation presented the media group’s investment in data acqInnuisition and analysis to support advertising sales, product development and marketing. Eilersten who recently joined Schibsted from US consultancy McKinsey highlighted the investment required in data acquisition and analytics, but also the need to build an internal business culture to make use of the data to solve complex business problems. Data in particular was the “secret sauce” in advertising networks that allowed a publishing company to create extra value from the advertising presented to their audience. Data and research was presented as one of the required success factors in the development and launch of paid content at sites as different as the New York Times and the TB+ premium content model developed by Tønsbergs Blad, from a small town southeast of Olso.

Content marketing or native advertising was another important area of discussion. In content marketing, the role of advertiser and publisher are increasingly blurred. Advertisers are now supplying, choosing or at a minimum approving content for publication on news media websites in exchange for an “advertising” fee. The advertiser recognizes that strong editorial brands offer special “brand benefits” to their audience. By associating themselves closing with strong news brands, advertisers enhance their own brand credibility and recognition. There were many potential implications of this discussion. The movement of advertisers to create their own media and sidestep news media for brand advertising was one important implication. Bennetton’s Colours magazine or Google’s advertising and marketing quarterly Think+ were cited as examples of this trend. For publishers, content marketing creates the need for a clear and well articulated plan for how to create and present “advertiser content” in order to maintain the overall credibility of the news brand. Finally, speakers highlighted how publishers will increasingly need to think about investing in the brand of their news media in order to create value in the publishing brand not in just the audience for an individual story.

Finally, the conference came back to its roots and presented some interesting programs to enhance the reception and profitability of the printed product. Two examples of this approach stood out. First, presenters from Die Welt Kompakt and NRC.Next presented content packages developed to target young professionals. But other examples targeting children as well as women reminded the conference that targeted content well-delivered can still create an audience attractive to advertisers. The second approach to the product development came from Sandy MacLeod, Vice President Consumer Marketing and Strategy at The Toronto Star who presented several examples of well researched and well delivered content products like improved TV guides and puzzle books provided for a price. MacLeod made the compelling case that there is still revenue available for the print product, if you look for it.

The INMA European News Media Conference provided a wealth of examples for regional media companies to pursue. For many in the audience the challenge is how to minimize the risk to developing, customizing these models to their different media markets. For large companies like Schibsted, Axel Springer or Sanoma Corp, there are ample corporate profits available to experiment without too much risk. Internally these companies have the ability to raise internal start-up capital and to recruit and train media managers with digital capabilities. The challenge for smaller companies lies in finding resources, both talent and capital, to develop experiments. But the need to continually experiment, measure, improve or discontinue new products was presented repeatedly as one of the fundamental requirements to success in the emerging multiplatform world of news media.

]]>- The Seminar presented the following topics:“Technology Platforms & Decision Criteria”. The presentation outlined the key decisions involved in selecting and maintaining web platforms. The presenter discussed the pros and cons of in-house versus outsourced development as well as proprietary versus open source software. Detailed decision criteria are recommended. Because of the importance of the Content Management System, the presentation closes with a comparison of the three open source CMS platforms – Drupal, WordPress, and Joomla.

- “Product Management Roles and Responsibilities”. The presentation focused on the role of product management as a ‘translator’ between the needs of users and technology’s ability to deliver web products to meet these needs. In particular, the seminar outlined key elements in a business plan and product specification. Examples of online and software products used to support the product development and bug tracking processes are also included.

- “Opportunities in Online Advertising”. The presenter detailed the elements of online advertising standards including pixel dimensions, file size and other graphic requirements. The discussion outlined new trends in online advertising targeting including behavioral and contextual targeting. The rapid emergence of real-time bidding or programmatic buying and its key components is also introduced with specific examples and a summary of companies working in the Russian/Ukrainian market.

- “Development Metrics: Measuring Your Site for Improvement”. This section presented a model for online metrics including examples of data sources and calculations. Three types of metrics are discussed. Foundation metrics provide basic audience behavior (visits, page views) and audience descriptions (location, gender, etc.). Key Performance Indicators (KPI’s) are discussed in terms of developing measures that assist in making business and content decisions to optimize websites for traffic or revenue. Finally, tactical measures like A/B testing and heat maps are introduced as techniques to acquire specific information to make tactical decisions about a website.

- “Website Hosting Fundamentals”. The Seminar presented the key types of hosting, their different uses and recommended criteria for selecting hosting methods and vendors.

The Seminar aimed to provide media managers with decision-making and management techniques for working with technology including content management, advertising and ad serving, and metrics systems.

Location: Moscow, Russia

Dates: 9 – 10 October 2013

Attending: Russian and Ukrainian Technology, Product and Commercial Managers

]]>- Day 1 – Audience Development. Day 1 focused on the two main techniques needed to build audience online search engine optimization and search engine marketing and social media optimization and social media marketing. Special emphasis was placed on the use of Facebook and Twitter given the related importance of social media to Indonesian online users.

- Day 2 – Revenue Development. Day 2 focused on revenue development, in particular display advertising trends and standards, pricing approaches and the importance and structure of online media kits and rate cards. The day ended with a discussion of the structure and role of advertising networks and the most important advertising networks available in Southeast Asia.

The seminar was designed to lay a foundation for audience and revenue development for KBR68H’s new online portal.

Location: Jakarta, Indonesia

Dates: 30 April – 1 May 2013

Attending: Sales, Marketing and News Managers from PortalKBR.com

The seminar presented the following topics:

- “Market Overview”. This section provided an overview of the online classifieds market with special focus on recent developments in the Russian and Ukrainian markets. The overview also discussed current trends in global online classified and directory development and presented strategic models for local media to participate in the online classified market.

- “Business Models: Classified and Directory”. This section presented the common technical and design features common to most online classified sites and then presented a staged approach to building revenue models.

- “Listings and Sales”. A discussion of techniques needed to build the listings volume for an online classified site.

- “Audience/Marketing”. A discussion of SEO and other techniques to generate audience to an online classified site.

The goal of the seminar was to create a base of understanding of the trends in the online classified market and the potential impacts on attendee’s existing classified business as well as provide some tools and techniques to help build listings volume and audience for attendees’ existing classified sites.

Location: Moscow, Russia

Dates: 1 -2 April 2013

Attending: Russian and Ukrainian media executives

]]>

The key challenge facing media in the developing world, especially print media, is to decide how to respond to this digital transition. There are two key questions, the answers to which will help create a successful response.

- Are classifieds or their close relation directories important to your business today?

- What unique strengths can your organization use to compete online?

The answers to these two questions should guide media companies in markets where the transition from print to digital classifieds is underway.

Media companies around the world have used the power of their printing capabilities and their audience reach to build print classifieds into a key revenue stream for their news business. In some media houses, classified revenue contributes a substantial portion of topline revenues but, more importantly, bottom line profits. These profits have been essential in supporting the public service mission of journalism. For instance, when an import/export firm in Hong Kong pays the South China Morning Post to place a recruitment ad for an accountant, they are in part subsidising the cost of the paper’s newsroom. When this type of cross-subsidy is substantial, a news media house must think carefully about how to respond to the inevitable pressure that online classified competitors bring. How these classified-oriented media houses respond will be in part a function of how they answer the second question about their competitive strengths.

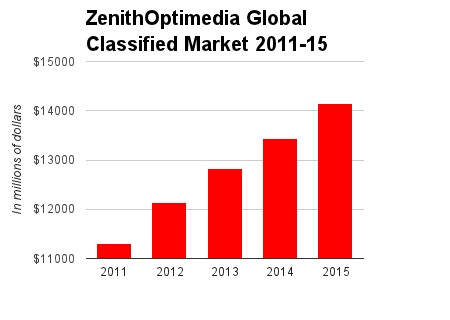

Media houses that do not have a traditional classified business may think that they don’t have a problem because they have no classifieds revenue to lose. But they still need to develop income from their online activities, and building a digital media business is not easy. Most successful digital media strategies include revenue from multiple sources, some from advertising, some from paid content, some from syndication, perhaps some from online classifieds. Zenith Optimedia, a global advertising research firm forecasts the global online classified market to grow to over $14 billion by 2015. So, problem? No. Opportunity? Perhaps. How your media house responds to the online classified opportunity will also reflect the answers to the second question.

Honestly evaluate your competitive strengths

When answering question two, two phrases stand out – “unique strengths” and “compete”. The classified business is a simple business. People have things to sell to other people who want to buy them or, in the case of a company who needs to hire staff, companies have jobs to offer to people who want new jobs. It is an exchange.

There are two types of classifieds markets that have been shown to work well: high volume markets where a lot of people have a lot of things to exchange, and niche markets selling items that are otherwise hard to find. Classifieds sections for jobs, cars, apartments or used PCs tend to be high volume markets, with a large audience of buyers attracting a large audience of sellers, which in turn attracts more people looking to buy. Such markets, once established, become self-perpetuating.

To evaluate your opportunity, you need to candidly evaluate your company’s strengths in an online classified competition:

- Existing Business – Does your company operate a classifieds marketplace offline? Have you built a successful exchange for goods and services offline that you can build upon to compete online?

- Audience – Can you provide more potential buyers to the online classified site than the online competition? Do you have the media reach that allows your company to build an audience of potential buyers at a lower cost than another competitor?

- Sales – Can you provide more potential sellers to the online classified site? Does your company have a unique ability to sell advertisers into the online classified site?

- Technology – Does your company have unique understanding of how online classified buyers and sellers use technology that will allow your company to build the best “product”? Perhaps most of the online classified competitors in your market are focused on building websites, when most buyers and sellers rely on their mobile phones?

- Reputation/Brand – Does your company have a strong reputation or a unique brand in the market? Will buyers and sellers be more likely to trust your company with their exchange than they might a new online only company?

- Unique Knowledge – Is there something unique about your market that gives you unique understanding about how buyers buy and sellers sell their products? The internet has not only forced a transition from traditional media to digital media; it has also created new specialty markets for buyers and sellers that never existed before. Fivrr.com, a specialty site where people exchange small jobs online for five US dollars, has become one of the most successful new classified sites in the last few years. According to Alexa, Fivrr today is one of the top 500 sites in the world and among the top two hundred sites in countries as diverse as Sri Lanka (#47) and Australia (#62).

Survey the competitive landscape

How to deploy these strengths will be a function of the competitive environment. In many markets, online classifieds competitors rely on technology as their main strength. They build a single online site that can be easily expanded to any region or category of goods, for example, Avito in Russia and Quikr in India. Other competitors will focus on a particular category, like recruitment, real estate, or automobiles and build a national online site for that category, such as PropertyGuru in Malaysia and Rabota.ua in Ukraine. Usually both approaches will exist in a market at the same time.

Another question to consider is whether your market’s size or location provides some insulation from national online classified competitors. Most classifieds markets are about building the largest exchange of buyers and sellers, and online classifieds are no different. This means that national competitors often focus on metropolitan regions with large populations and easy access to the internet.

This leaves opportunities to create niche local or specialized classified marketplaces. These opportunities are often found in smaller markets with high internet penetration or, in a non-geographic strategy, very focused interest groups may also develop an online classified site. One example of a successful specialty classified site is the BandMix.com which, with its partner site ReelMix.com, focuses on the special needs of musical bands or film crews recruiting for talent.

When you are assessing the market, you must be clear that there is an opportunity there to be exploited. If the market is already too competitive or your organization’s strengths do not match the requirements of the market, then this may not be the best opportunity for your company.

Choosing a strategy

After evaluating the online classified competitors and determining whether your organization has unique strengths needed to succeed in the market, you will need to develop a strategy. There are four types of strategy, each of which build on an understanding of your company’s unique strengths and the competitive environment.

- Traffic Sponsorship. In this strategy, the media company creates a partnership with a leading online classified site to provide traffic, to build the number of buyers and sellers on their exchange. This strategy is the least risky. Media companies pursuing this strategy often face multiple, well-established online classified competitors. In this case, the partnership offers the online classified competitor access to the traffic of the company’s news site. The online classified site almost always pays some base fee for the traffic and then perhaps a bonus if the traffic levels reach pre-set goals. MalaysiaKini’s relationship with the PropertyGuru is a good example of this type of strategy.

- Sales and Marketing Partnership with Online Classified Sites. In this strategy, the company’s partnership expands to include not just traffic. This partnership builds on the media house’s sales and marketing capabilities to promote the online classified partner and to sell advertisers into the online classified site. Similar to Traffic Sponsorships, media companies choosing this strategy face strong online classified competition. But, in addition to online traffic, they also bring strong sales and marketing skills. The New York Times chose this approach when it partnered with Monster, the global online recruitment classified company.

- Build Your Own Online Classified Site. In this strategy, the company elects to choose its own technology to create an independent online classified site. The technology chosen can either be built or bought from a specialty online classified software company, like FlyNax or MarketGrabber. But the company’s ability to choose or build and then maintain its own classified software creates a significant new level of risk. This approach assumes that online competition is still limited or that the company has unique strengths in technology, sales and marketing or some unique market understanding will result in a successful online classified launch. AltaPress in Barnaul, Altai, Russia pursues this strategy with their online site KP22.ru, an online classified companion site to their successful print classified newspaper Kupi Prodai.

- Build a Network for Your Online Classified Site. In this strategy, several traditional media companies or a media holding company which owns several traditional media creates their own online classified site. This is the most risky strategy involving both the risk in the choice and maintenance of a technology platform as well as the risk created by linking multiple different media companies, each with different strengths and goals for the online classified site. The choice of this strategy often reflects a rapidly changing market where media companies have a significant stake in the traditional print classified industry. They have strong traditional classified brands, well-trained sales and marketing teams and a good foundation in technology. By pooling these strengths, they believe that they can create the necessary scale to successfully compete with larger national online classified companies.

Each strategy includes a number of different ways to capture potential online classified opportunities, but every media company will need to customize and adapt the strategy to their unique strengths and market situation. As new strengths are built and the competition reacts to shifts in the market, you should review and evolve your ongoing classified strategy to stay ahead of the game.

Classifieds is perhaps the oldest form of advertising. Although technology has changed the dynamics of the equation, the equation remains the same. Almost every community has their version of a classified “site”, whether it is on their mobile device, on their PC, in print or on a real bulletin board in a local café. The goal is to bring people together to create value for all, a mission not too dissimilar from the goals of any media company.

]]>To take advantage of this growth in internet advertising, we explore how to organise and motivate your sales team. Advertising sales is fundamentally about solving problems for your advertisers by providing them with products and an audience, at prices they are willing to pay.

In the next presentation we look at key sales concepts including:

• Calculating your potential advertising market.

• Identifying sales channels.

• Strategies for making money in print (or broadcast) and online.

• Motivating your sales force.

• Organising digital sales.

After looking at how to organise and motivate your sales teams, we look at two types of digital advertising: ad networks and classifieds. As we wrote about recently in the August Digital Briefing, ad networks can be an important source of early income as you grow traffic to your site.

Although a couple of large ad networks get the lion’s share of the attention, there are more than 300 ad networks out there, with some focused on specific platforms or technology such as mobile or video ad networks, some focused on specific geographical areas, others focused on specific themes or types of content such as the Active Youth Network and even others focused on audience behaviour online.

Ad networks help address a number of issues facing advertisers such as the large choice of publisher sites leading to an over-supply of ad space, and the difficulty of identifying high-quality content.

In the next presentation, we look at different ad network pricing models and how to choose the right ad network.

We look at classified advertising, beginning with a cautionary tale about the collapse of online classifieds as a revenue source for newspapers in the US. New online classified players such as Craigslist, Monster.com and HotJobs.com all helped to shift classified advertising from newspapers to new digital players. We look at how to develop your digital classifieds offering to prepare to defend yourself against new digital competitors.

Online classifieds include not only the “Big Three” of classified advertising – recruitment (jobs), real estates/rentals and auto – but also directories, free classifieds and calendars. Specialist classified providers that focus on dating, education or other types of products and services have also sprung up. Online classified advertising is in the early stages of development, but it still represents a potentially large market and has already attracted a number of large, international players.

We then cover several different strategies for developing your online classifieds business, including:

• Go it alone: building, selling and marketing your own classified advertising site.

• Build a network with other local media.

• Partner with a national site, which provides the technology and perhaps marketing and sales service, leaving you to focus on local marketing and sales.

• Enter into a traffic partnership, which means that you sell a traffic sponsorship deal to a national partner.

We look at examples of these strategies and how to organise your business to achieve success using one of these strategies.

Of course, digital advertising is a fast moving sector, so we also look at new developments and the future of the online classifieds.

In the final presentation, we look at how news organisations are using social media to generate revenue, either indirectly by using it to grow audiences and gain more data about their audiences, or directly by selling social media advertising.

]]>The Seminar presented the following topics:

- “Online Advertising Market Overview”. An overview of the dynamics of the Russian and Ukrainian online advertising market including market size and growth. The training focused on presenting the standards for online display advertising as well as an overview of standard pricing models. A short discussion of ad serving systems was also included.

- “Sales Teams Organization and Motivation”. A discussion of different approaches to sales organization and motivation as well as a discussion of integrated, independent, and hybrid online sales teams.

- “Advertising Networks”. Training provided an overview of the structure of advertising networks as well as a discussion of the pros and cons of participating in advertising networks like Yandex Direct and Google AdSense.

- “Measuring Success – Google Analytics”. An overview of the fundamentals of using Google Analytics to measure traffic growth and understand basic audience demographics and behavior.

- “Online Classifieds – Local Opportunities”. Online classifieds often represent the largest category of traditional local media advertising and are often the first category to move online. The training focused on the elements of the online classified market and techniques of managing the transition from print to online classifieds.

The goal of the seminar was to provide a common base of knowledge about the opportunities in online advertising both display and classifieds. The seminar also encouraged discussion among participants about the pros and cons of different online advertising techniques and the potential impact on the traditional advertising business.

Location: Moscow, Russia

Dates: 27 – 28 September 2012

Attending: Russian and Ukrainian Media Advertising Sales and Marketing Executives

]]>

The business seminar focused specifically on the unique aspects of building an online outlet for a radio station or network. The training included:

- “Developing a Strategic Plan”. A framework for building a strategic plan for an online media business. Special emphasis was given to presenting different models for an audio-driven online site.

- “Building Audience”. A broad overview of the techniques needed to build an online audience including streaming audio directories, iTunes submission, search engine optimization, and social media marketing.

- “Revenue Opportunities”. A discussion of different revenue opportunities including donation campaigns and fund drives, advertising including Google Adsense, and content sales and syndication.

- “Measurement”. A hands-on demonstration of the fundamentals of Google Analytics.

The goal of the seminar was to provide radio stations, radio producers, and radio networks with the foundation to develop sustainable online web sites for their radio operations.

Location: Siem Reap, Cambodia

Dates: 2 -3 May 2012

Attending: Affiliate Members of the Asia Calling Network, representing radio broadcasters and online media from Indonesia, Malaysia, Cambodia, Thailand, Myanmar, Pakistan, Nepal, and Afghanistan.

]]>

The seminar presented the following topics:

- “Trends in Online Business Development”. An overview of new international online media developments with a focus on online products and services, which specifically deliver local audiences and markets. In particular, the seminar looked at specialized directories, local aggregation and specialized social media developments as opportunities for new online product development.

- “Search Engine Optimization”. An overview of the fundamentals of SEO for both Google and Yandex.

- “Social Media Marketing”. An overview of the fundamentals of leading social media platforms Twitter and Facebook including step-by-step instructions around how to establish a social media profile, how to post to the profile and a discussion of the benefits of social media to traffic growth.

- “Measuring Success – Google Analytics”. An overview of the fundamentals of using Google Analytics to measure traffic growth and understand basic audience demographics and behavior.

- “Planning & Financing Your Business”. A discussion of the key inputs to a business plan including estimating audience, revenue and expenses.

The goal of the seminar was to provide senior executives and media managers with the fundamentals to understand the opportunities available and the techniques required to capture the local online media opportunity.

Location: Moscow, Russia

Dates: 19-20 March 2012

Attending: Russian and Ukrainian media executives

]]>